In the business world, cash flow is king.

Central to its rule is the efficient and timely collection of customer debts (account receivables). Waiting too long to collect on an invoice you are owed suggests that you may be giving away too much credit and puts you at risk of becoming a debtor yourself.

Here, we outline the importance of average debtor days and trends in collection periods by industry. Find out how your business compares and what you can do to improve your payment collection processes to get paid on time, every time.

Debtor days definition

Let’s start with a definition. In simplest terms, debtor days measure how quickly a business gets paid.

Average debtor days, also known as “day’s sales in accounts receivable,” are determined by dividing the average number of daily sales by the average number of debtor days. When we talk about “average debtor days”, we’re talking about the median amount of days that pass between issuing invoices and collecting payments owed from a client or customer.

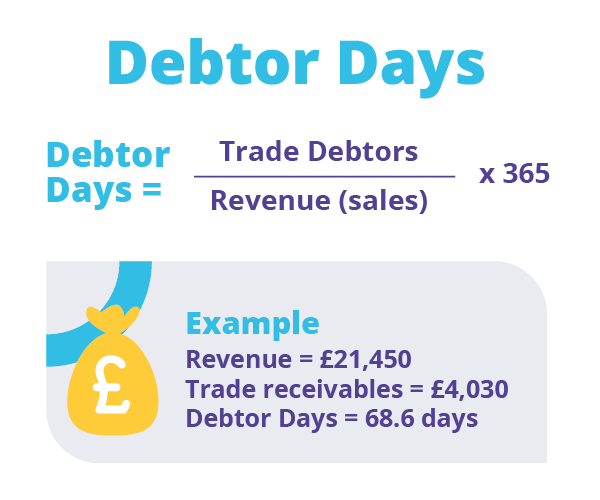

Also known as Day Sales Outstanding (DSO) or account receivables, debtor days are generally calculated over a set period of time such as on a monthly, quarterly or annual basis. Companies can use a variety of methods to compute their debtor day ratio but the standard formula involves dividing trade receivables by sales revenue and multiplying the result by the number of days in the chosen period.

The below example is a fictional representation of average debtor days calculated over a 12 month period:

Is the debtor days ratio really that important?

Yes. The debtor days ratio at its core, is an indication of the company’s liquidity.

By tracking your average debtor collection period over time, you can identify trends and fluctuations that indicate positive or negative sways.

A rise in the number of average debtor days could signal that you may be giving too much credit to your customers; your clients are not creditworthy and/or there is an issue with your payment collection process. With less cash on hand you may not be able to invest in your company’s growth, meet your own payment obligations (such as loan repayments and staff salaries) and end up being the one in the red. Gulp!

Conversely, a diminishing number of debtor days should always be considered against historical context. Many businesses are affected by seasonality and report fluctuations in their cash flow according to the time of year. The message here is clear: average debtor days calculations must be included as part of your ongoing cash flow management.

Average collection period in business: An industry snapshot

![]() All companies strive to reduce their average collection periods but new data released by insolvency specialist, Begbies Traynor, suggests that there is a worrying increase in late payments.

All companies strive to reduce their average collection periods but new data released by insolvency specialist, Begbies Traynor, suggests that there is a worrying increase in late payments.

According to the research, which was compiled from more than a million debtor day reports since 2011, close to 115,000 companies waited an average 57 days for payment in 2018. Of this number, more than 1,000 businesses entered insolvency.

Media companies reported the longest wait, tipping the scale at 69 days. They were closely followed by the information and telecommunication sector (68 days) whilst the travel and tourism sector saw a 5% increase in debtor days between 2011-18 to take their average collection period up to 48 days. General retail also witnessed a 2 day rise from 41 to 43 days to receive payment during the report period.

Is there a problem with SMEs?

We’ve got to talk about SMEs. Evidence suggests that small businesses are adversely affected by the trend in late payment increases.

According to ABFA, the gap between the smallest and largest companies in terms of average payment period is significant, with SMEs waiting over a month longer to get paid. That’s an average wait of 71 days for companies with a turnover less than £1million compared to a wait of 38 days for the largest companies.

.

With smaller companies less able to bear the brunt of unexpected or increasing debts, the effect of cash flow disruption upon business growth, suppliers, staff and creditors is palpable. It has been estimated that as many as 50,000 SMEs collapse each year due to issues connected to late payments.

Ways to improve average debtor days

![]() So, what can be done to help collect trade receivables on time, every time?

So, what can be done to help collect trade receivables on time, every time?

The answer to this lies in adopting a robust and efficient payment collection process. For many, this includes:

- setting up clear payment terms

- correct and prompt issue of invoices

- early payment incentives if appropriate

- accessible payment options

- open lines of communication with debtors

But sometimes, even with the best of intentions, your debtors may forget to pay. Your invoice falls to the bottom of their “to-do” list and your staff are now faced with spending precious time chasing a late payment.

This is where Direct Debit can offer an affordable solution. As an automated payment method, Direct Debit does it all automatically, enabling you and your staff to get back to vital business functions. No chasing, no late payments. Direct Debit puts you in control of your collections.

FastPay Ltd is an established Direct Debit service provider with a proven record in excellent customer service. Trusted by businesses of all sizes, charities and organisations, FastPay are there to help make your life easier. Offering flexible and transparent pricing with no monthly or yearly fees, the dedicated team of Direct Debit experts can get you set up and start collecting in 24 hours.

How do you calculate debtors’ balances?

Dividing the average accounts receivables by the annual net revenue and multiplying by 365 days will produce the debtor days ratio.

Average accounts receivable, divided by average daily sales = Receivable Days Formula.

Contact the Direct Debit specialists at FastPay today

Let’s work together on your cash flow solution.

Call 0161 737 5290 to speak to a friendly member of the FastPay team.

Alternatively, you can request more information about our Direct Debit business services by completing the online enquiry form.

Lastly, find out what it’s like to work with us by viewing our happy client testimonials.